Costco Daily Recap, 1970s Playbook, FedWatch Says One Rate Cut, Gold and Silver Charts

Weekly Recap for the Week Ending April 19, 2024

1. Costco Daily recap (April 12 - 18)

These are the daily deals in Costco bullion that were captured over the last week. This has been the strongest week since Costco Daily alerts began.

(4/12) 1 oz Gold Bar Rand Refinery at Costco…$2,369.99

(4/15) 2024 1 oz American Silver Eagles 20-count at Costco...$659.99

(4/15) 100 Gram PAMP Gold Bar at Costco...$7,399.99

(4/16) 2024 1 oz American Silver Eagles 20-count at Costco...$659.99

(4/16) 2024 1 oz Maple Leaf Gold Coin at Costco...$2,449.99

(4/17) 1 oz Gold Bar PAMP at Costco...$2,449.99

(4/17) 2024 1 oz Canada Maple Leaf Coins 25-count at Costco...$779.99

(4/18) 50 Gram PAMP Gold Bar at Costco...$3,949.99

(4/18) 2024 1 oz Gold Eagle Coin at Costco...$2,469.99

(4/18) 2024 1 oz Gold Buffalo Coin at Costco...$2,469.99

Check out my 40 Emergency 'Go Bag' Essentials From Amazon

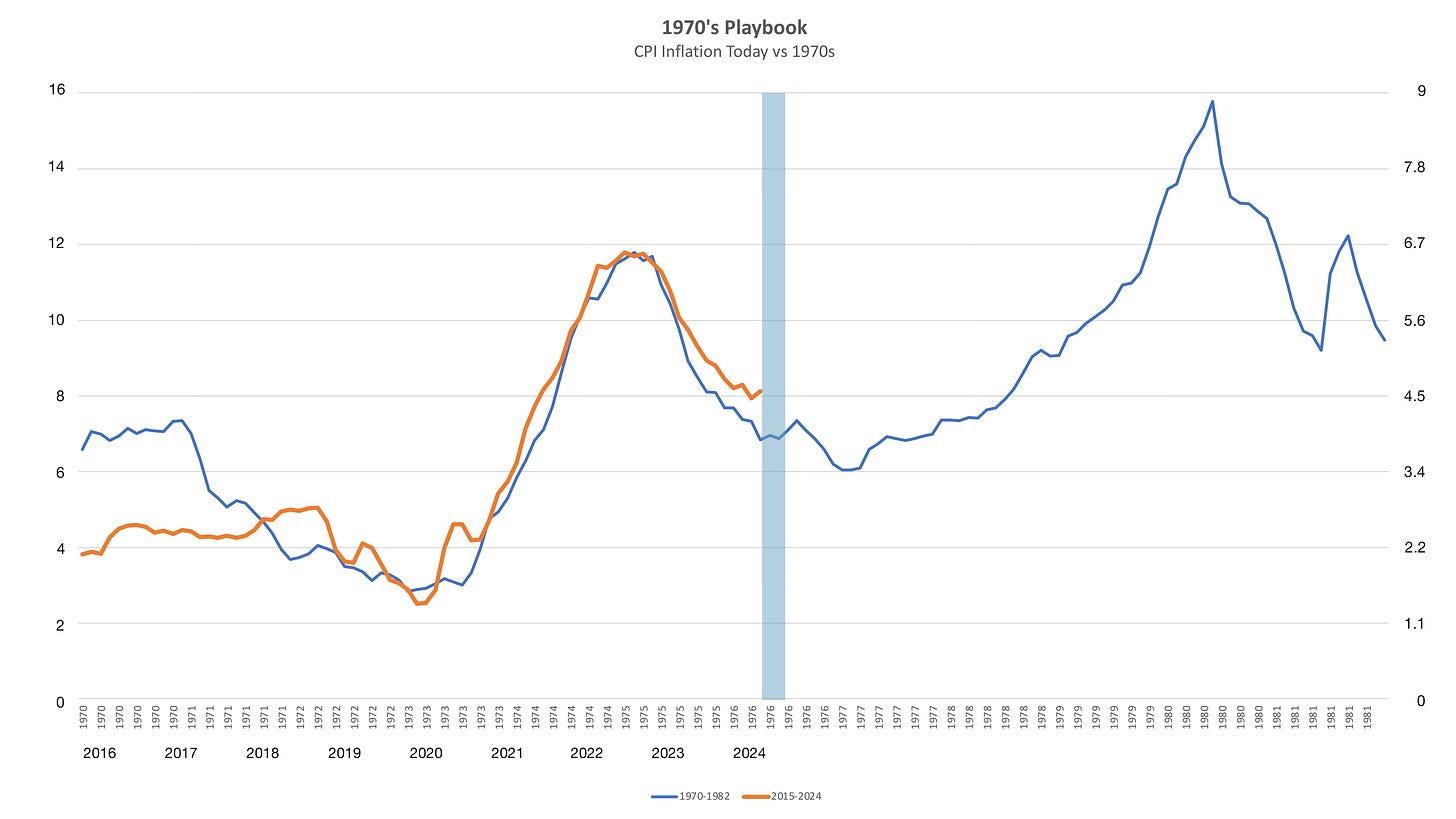

2. The 1970s playbook

We got an update from FRED which showed an uptick in inflation for March. We expect a general trend down in inflation for the 1970s playbook to remain in play. Maybe it’s broken but I don’t think so.

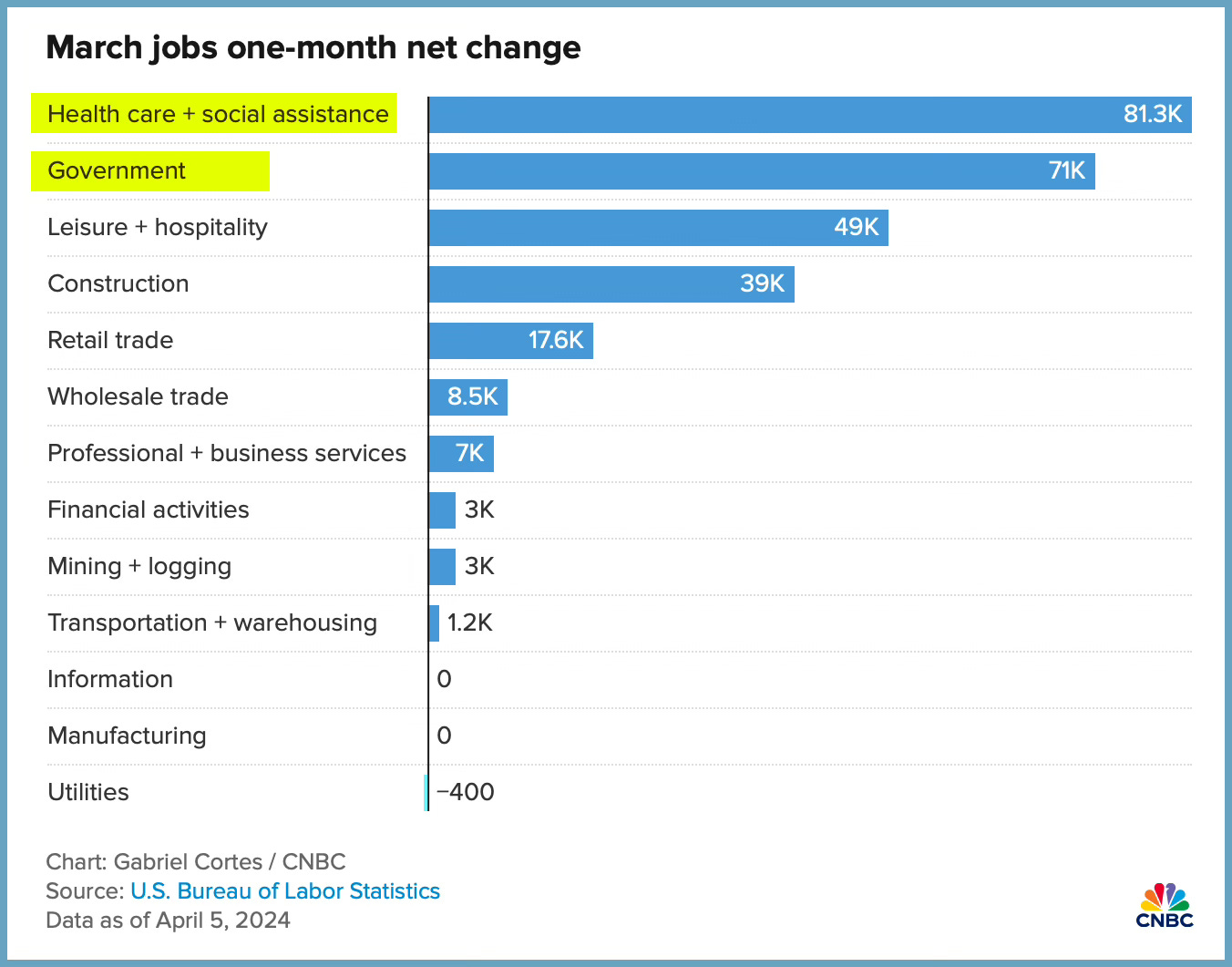

The problem the economy is having, and it is having a problem, is that unemployment numbers remain low due to “make-work” jobs. This makes the economy appear strong while in reality, those jobs are not contributing to wealth creation but rather wealth transfer.

Look at this chart to get an idea of where new job creation is taking place.

Government and government-adjacent healthcare jobs dominate the current job growth numbers. While these jobs provide employment, some argue they don't directly generate wealth for the economy as a whole. They are funded through taxes, which can be seen as a transfer of wealth from the private sector. In contrast, private sector jobs can create wealth by producing goods and services people are willing to pay for. This wealth creation then fuels further economic growth.

What this all means is that while Fed Chair Powell might make temporary progress against inflation, the underlying factors suggest it could easily surge again, making high inflation a persistent threat. Families will continue to struggle while the economy seemingly is doing fine.

JPMorgan CEO warns:

[W]e are prepared for a very broad range of interest rates, from 2% to 8% or even more, with equally wide-ranging economic outcomes — from strong economic growth with moderate inflation (in this case, higher interest rates would result from higher demand for capital) to a recession with inflation; i.e., stagflation.

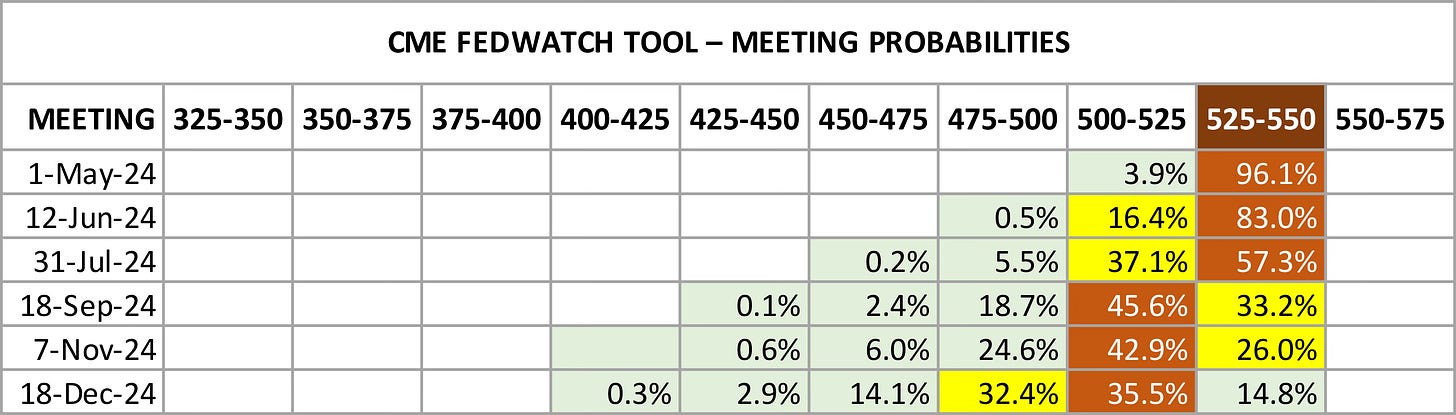

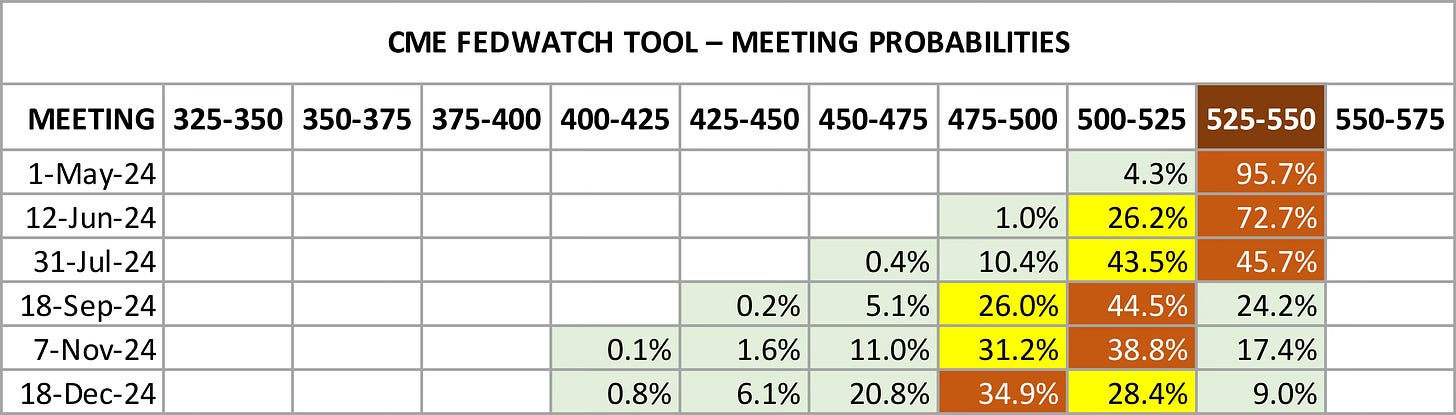

3. FedWatch expects one rate cut this year

The first expected rate cut is out to September, according to the CME Group FedWatch tool.

The most likely scenario is one rate cut in September or November (red shade) and no more cuts for the rest of 2024, totaling just 25 basis points.

4. Gold and silver charts

Gold

Sale prices (green shade) have reduced overall but physical gold coin buying continues to increase along with rising gold prices. As investors get used to these higher prices, with a floor possibly in at $2,400, buyers aren’t shying away

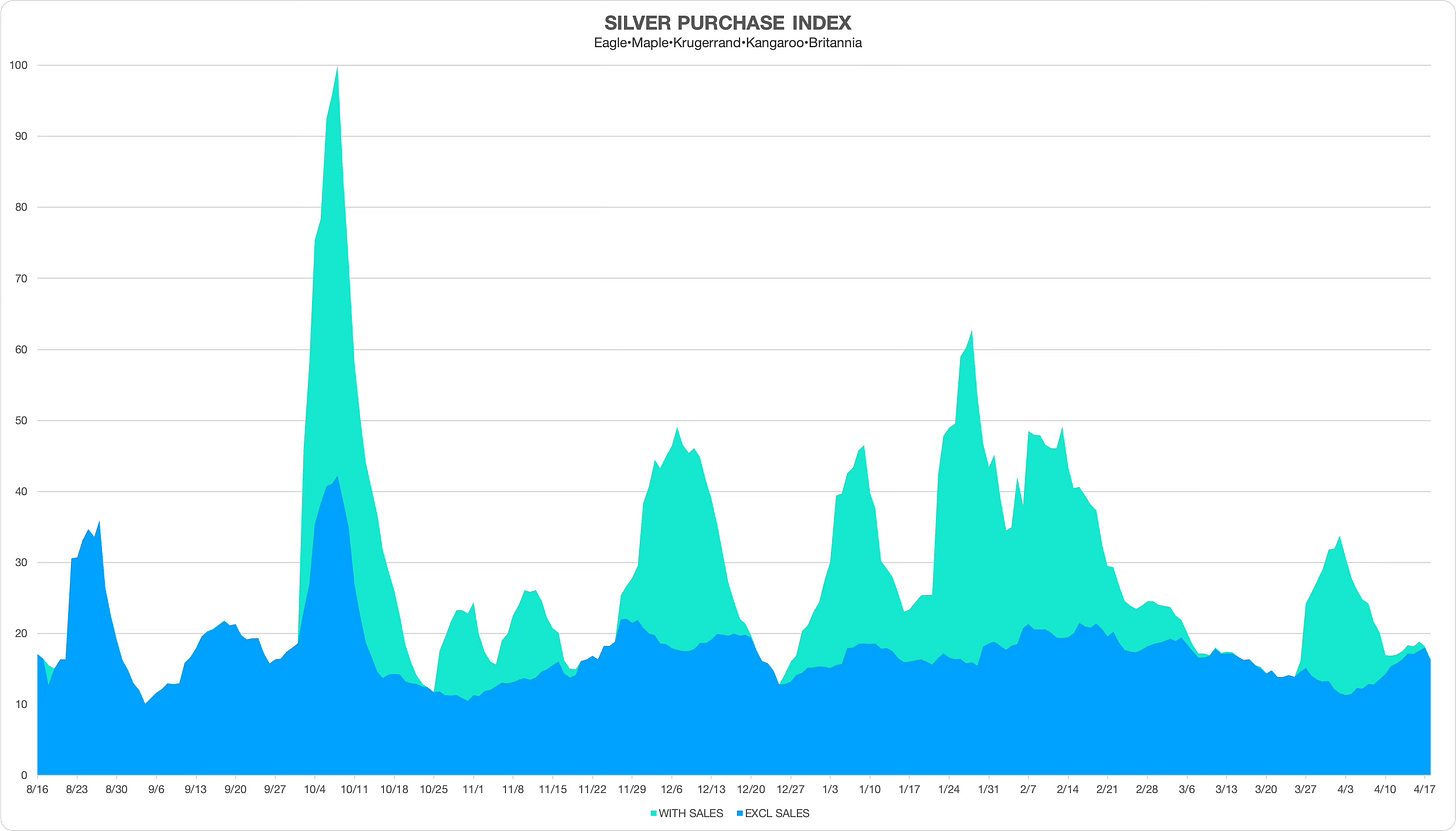

Silver

Regular-price silver bullion volume has picked up a bit, pulling out of the recent slump, but only enough to match February volume. Buyers are still not willing to chase physical silver prices higher.

Disclaimer: City Stacker is intended to provide general information and personal opinions related to disaster preparedness and investing in precious metals. I am not a certified financial planner (CFP), chartered financial analyst (CFA), or a certified public accountant (CPA). The content of this publication should never be considered a substitute for professional financial advice. Before taking any action based on anything within this publication, you should always consult with a qualified financial professional familiar with your unique situation. Investing involves risks, and I am not liable for any investment decisions made or results obtained from the use of information in this publication.