Gold Prices Disconnect From Fed, FedWatch Adds Rate Increase, Gold and Silver Charts

Weekly Recap for the Week Ending April 5, 2024

1. Gold prices disconnect from the Fed

The following strong jobs report from the BLS should have sent precious metals prices downward.

The labor market continues to thrive, with March job creation easily surpassing expectations. Nonfarm payrolls jumped by 303,000, well above the projected 200,000 and February's revised growth of 270,000, as reported by the Bureau of Labor Statistics.

After all, that was the reaction in the treasury market.

10-year Treasury yield jumps after stronger-than-expected jobs report.

The Fed has been in the driver’s seat for precious metals prices for well over a year now.

Investors expect that falling Federal Reserve interest rates would boost gold prices by weakening the dollar and making gold a more appealing investment. However, a strong labor market reduces the likelihood of those rate cuts, which in turn could keep gold prices down.

Except it didn’t this time.

Today, gold is up 1.64% to $2,345 and silver is up 0.97% to $27.45.

Has the Fed lost control of gold and silver pricing? While it’s too early to tell I think we could say that they are in the process of losing control.

Conflicts around the world are not de-escalating. Internal conflicts are not de-escalating. BRICS is de-dollarizing (the removal of the dollar as a reserve currency). China and other central banks are stacking tonnes of gold. Could this be the Force Majeure moment? Time will tell.

Check out my 40 Emergency 'Go Bag' Essentials From Amazon

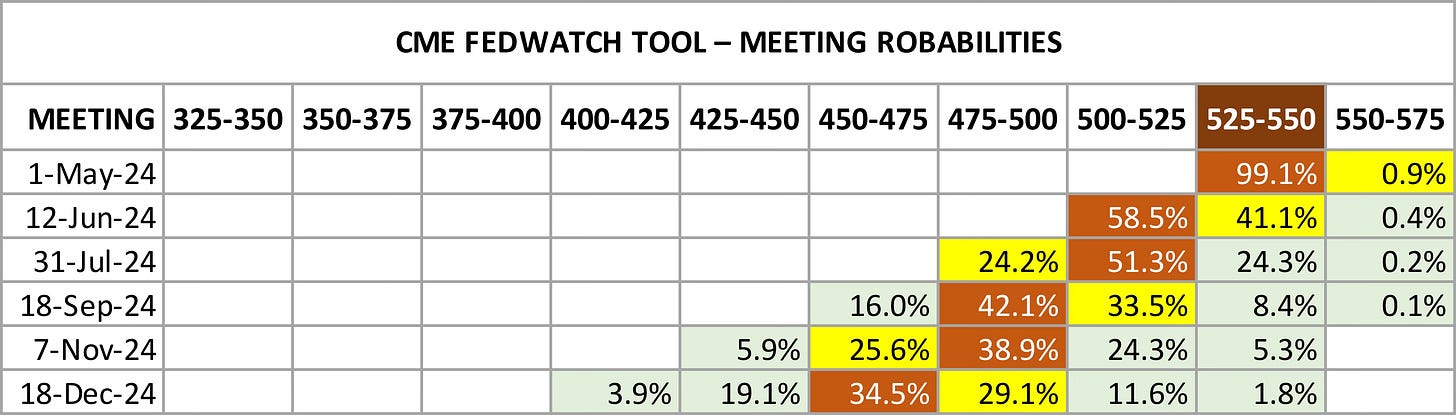

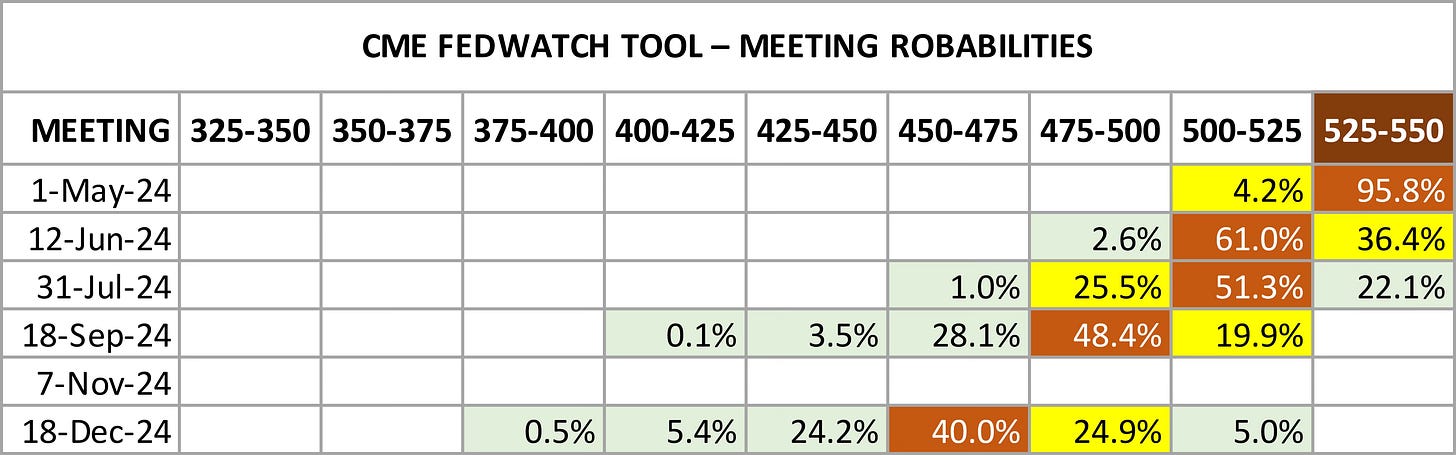

2. CME FedWatch chart

Something significant has changed in the CME FedWatch data… There’s now the possibility of rate increases in 2024. Although less than 1% for now, a move up to 550-575 just showed up in the charts.

Still, the most likely scenario is one rate cut in June or July and then two more in September/December for three cuts totaling 75 basis points.

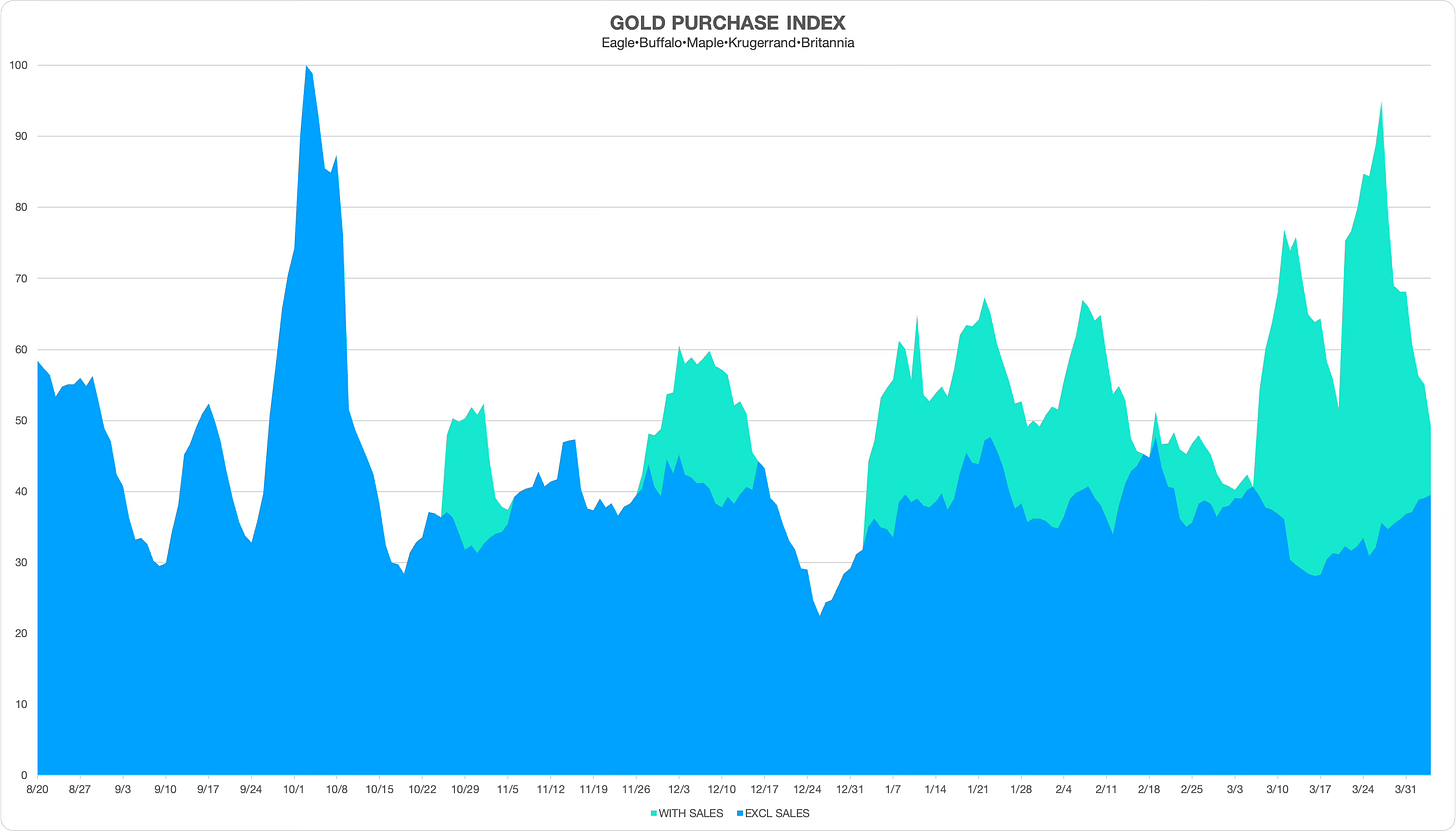

3. Gold and silver charts

Gold

Sale prices (green shade) have reduced overall but physical gold coin buying remains steady. As investors get used to these higher prices, with a floor possibly in at $2,300, buyers aren’t shying away.

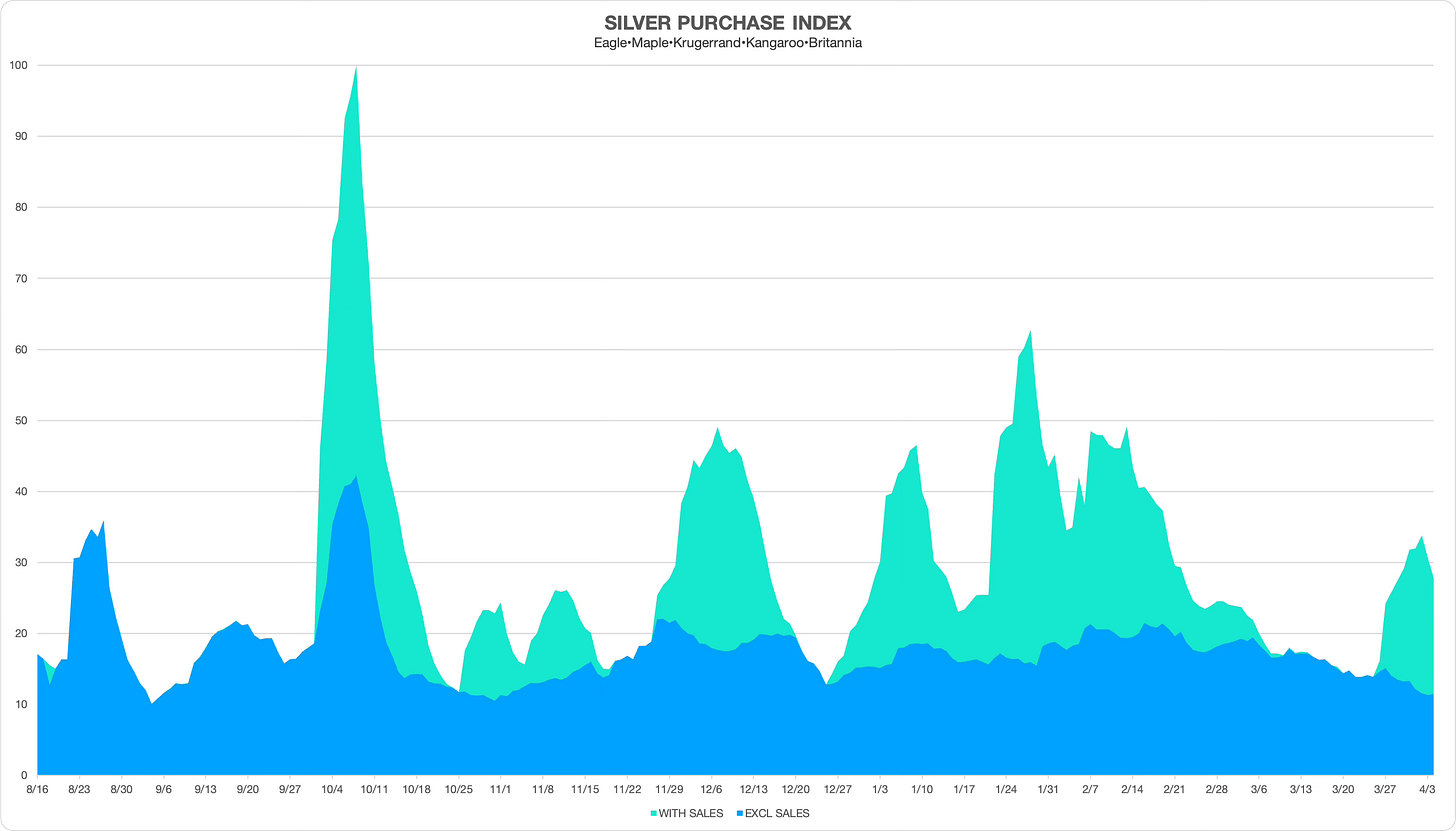

Silver

We’ve seen some dealer discounts in silver coin premiums (green shade), but overall those are pulling back. Regular-price bullion volume has been trending down since February showing that buyers are not willing to chase silver prices higher.

Disclaimer: City Stacker is intended to provide general information and personal opinions related to disaster preparedness and investing in precious metals. I am not a certified financial planner (CFP), chartered financial analyst (CFA), or a certified public accountant (CPA). The content of this publication should never be considered a substitute for professional financial advice. Before taking any action based on anything within this publication, you should always consult with a qualified financial professional familiar with your unique situation. Investing involves risks, and I am not liable for any investment decisions made or results obtained from the use of information in this publication.