Powell Kills March Hopes, Great Retirement, Fedwatch Updated, Gold and Silver Charts

Weekly Recap for the Week Ending February 9, 2024

Domestic Events:

1. Powell speaks

During a 60 Minutes interview, Fed Chair Jerome Powell reiterated that they wouldn't wait to get to 2% to cut rates. It's between 2-3%.

Inflation is coming down but they “don't expect to see a decline in the overall price level.” High prices in the overall economy are here to stay.

“We want to be more confident that inflation is moving down to 2%.” Powell continues “…it's not likely that this committee will reach that level of confidence in time for the March meeting.”

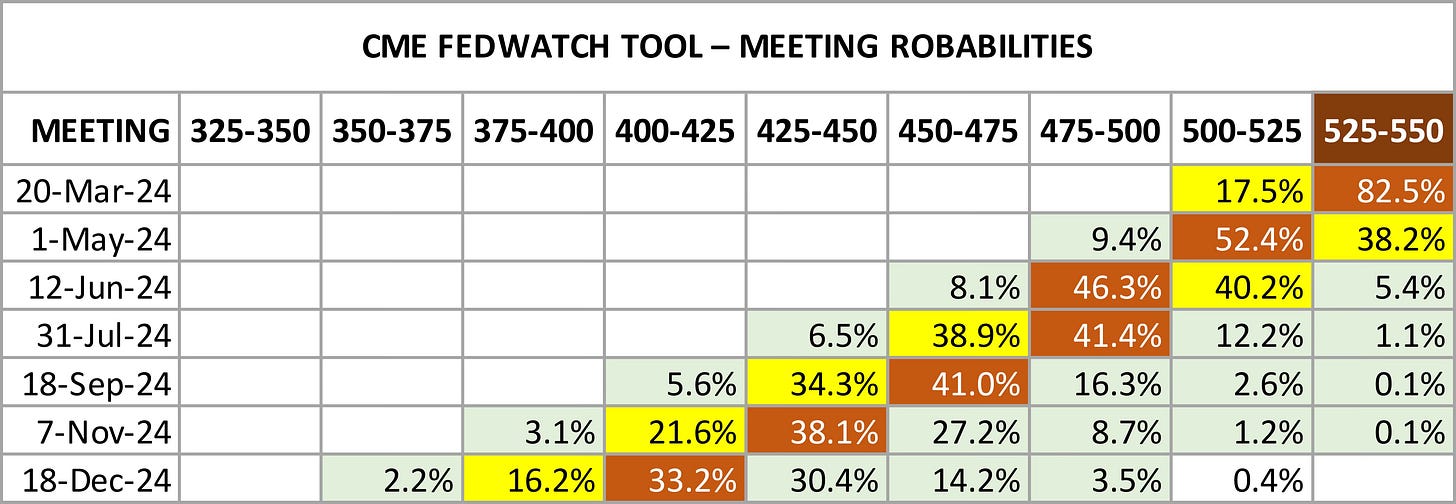

Following Chairman Powell’s comments, a March rate cut was taken off the table.

Recent developments have increased the probability of rate cuts occurring in June or July, currently estimated at 46.3% and 41.4% respectively. This prediction is supported by the absence of a meeting in August, making July the last opportunity for action before a potential economic slowdown in November.

It's important to remember that Chair Powell, like many economists, initially anticipated inflation to be short-lived in 2021, alongside measures taken to stimulate the economy during the pandemic. They got it wrong back then so there is a possibility that they get the timing wrong this time.

For investors in gold and silver, delayed rate cuts might indicate a longer wait before seeing a Fed-induced price surge. However, other economic factors like inflation, market sentiment, and global tensions can also significantly impact precious metal prices. Geopolitical instability and potential banking crises, while difficult to predict with certainty, could still act as catalysts for price increases. Investors should consider a holistic approach, analyzing diverse factors and potential scenarios before making investment decisions.

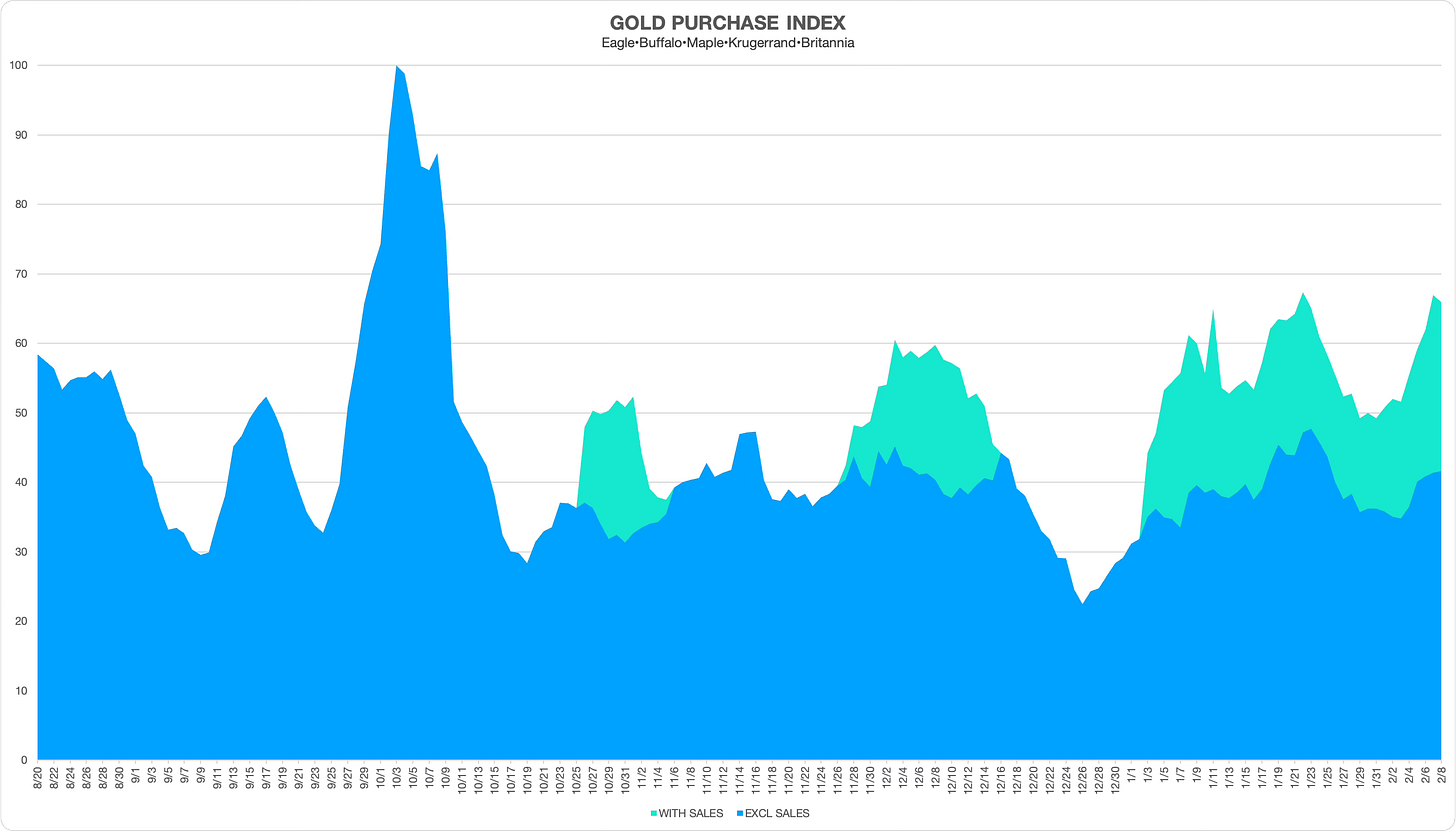

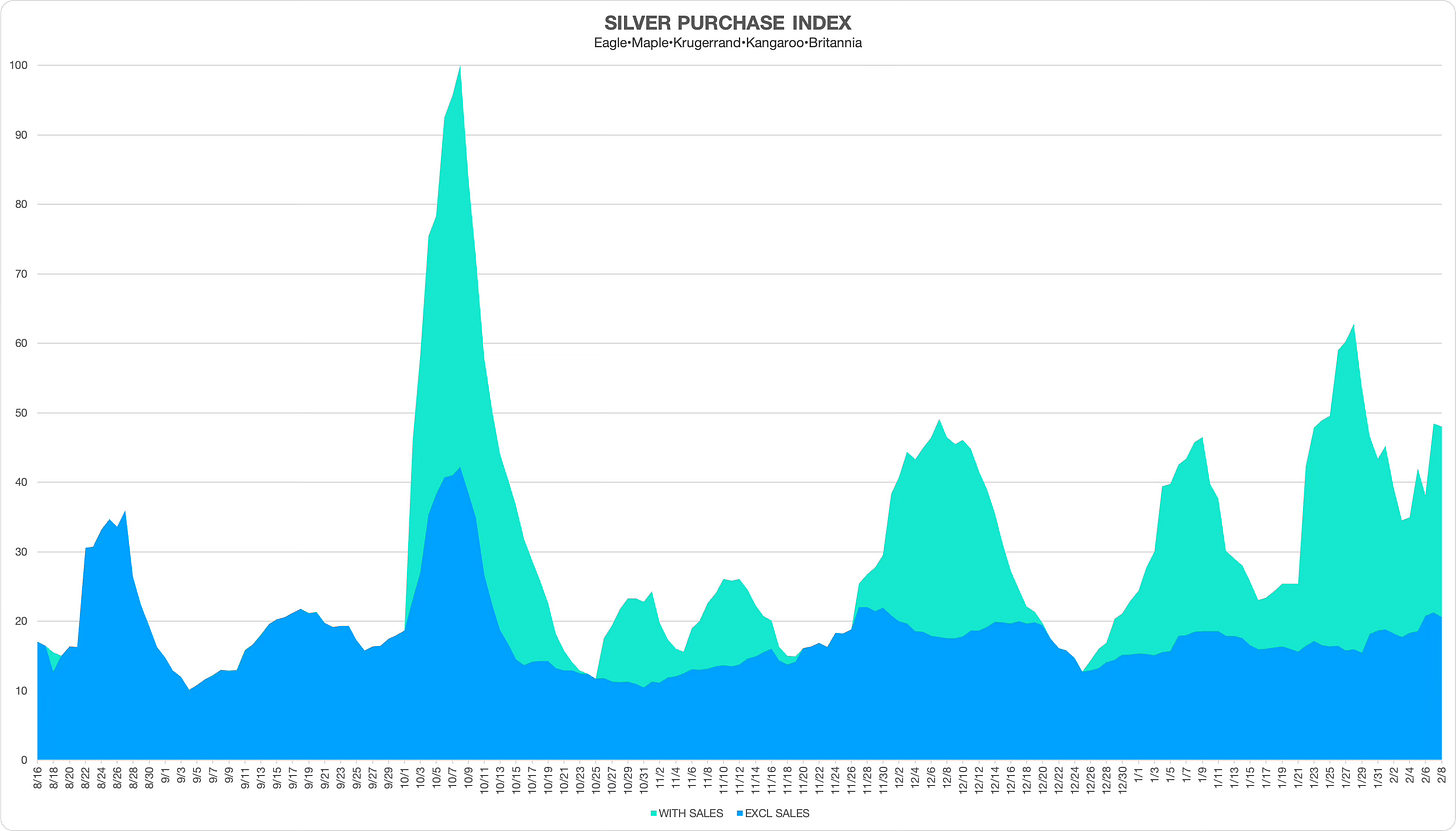

2. Gold and silver charts

Strong sales events continue in both gold and silver. In the charts below, the blue shaded area means customer volume of regular-priced bullion while the green area indicates purchases of sale-priced items.

Silver especially has been on a prolonged streak of sales since December 26 with a very high volume.

Sale prices mean lower premiums on physical gold and silver. This reduced profit margin for dealers is likely being compensated by increasing volume.

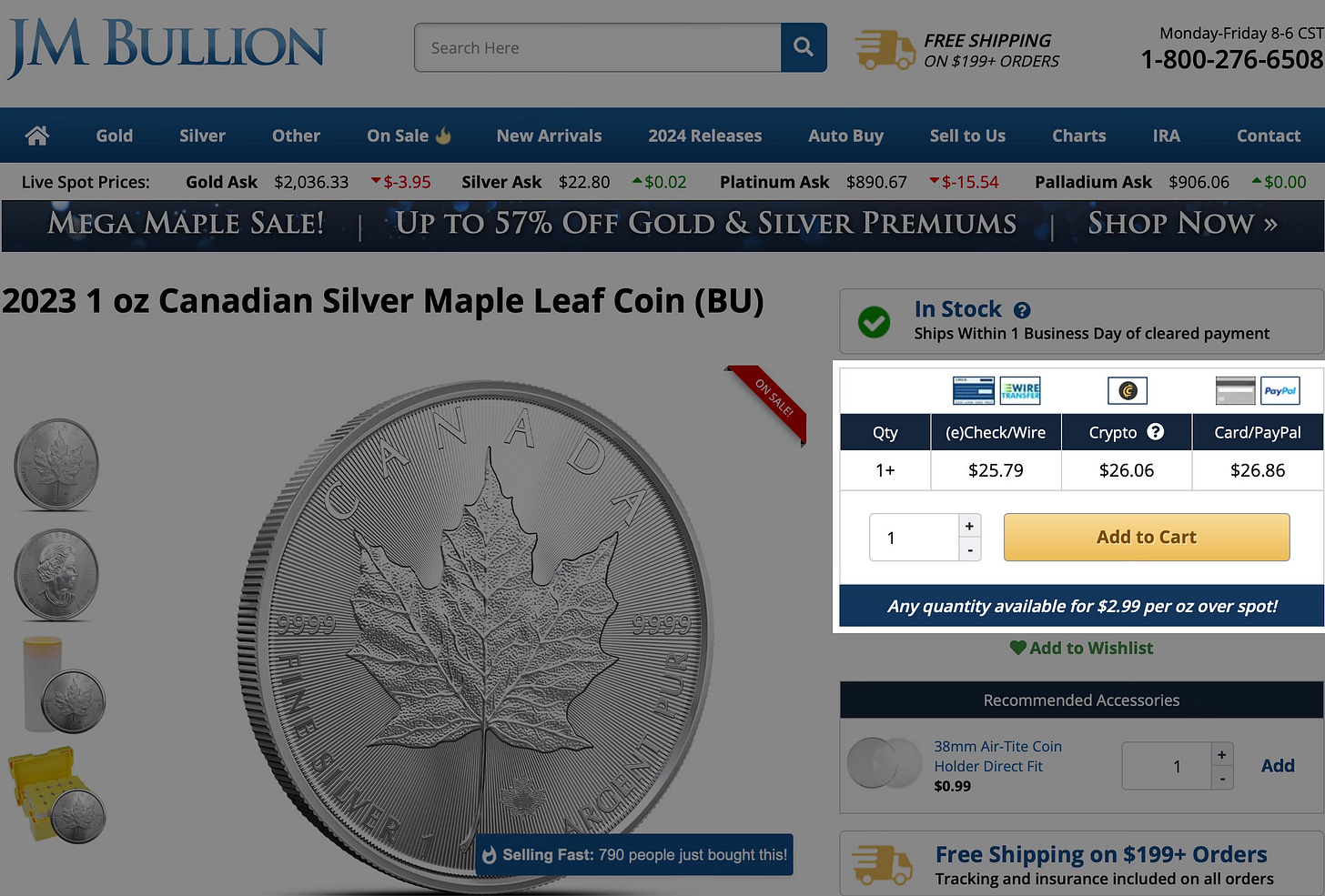

3. The mother of all Maple Leaf sales

JM Bullion is currently offering Canadian Gold and Silver Maple Leaf coins at a premium of $2.99 over spot, potentially one of the lowest prices they've offered in the past year. The lower premium could be part of a broader trend within the precious metals market, where some dealers are offering discounts to increase sales velocity. This could be an opportunity for investors looking for competitive prices on these popular coins. However, it's important to research and compare prices from multiple sources before making any investment decisions.

4. Great Retirement

The U.S. is in the midst of another ‘Great Retirement’ wave.

Source: Bloomberg (paywall)

Baby boomers were projected to trigger a wave of retirements as they aged. The COVID-19 pandemic accelerated this trend, leading to a surge beyond expectations, aptly named the "Great Retirement Boom." While this initially appeared to be subsiding, recent months have seen another unexpected spike, with December 2023 marking a post-pandemic peak in retiree numbers.

The number of retirees in the U.S. has reached a level 2.7 million above what economist Miguel Faria-e-Castro predicted in his Federal Reserve Bank model.

Two factors might be contributing to the recent surge in retirements: anticipated interest rate cuts and a dip in inflation, both potentially making existing retirement more financially sustainable. Additionally, some employers' stricter work-from-home policies and pressure to return to the office might be pushing some workers toward early retirement.

Increasing retiree numbers put pressure on the already strained Social Security system. The Social Security Administration (SSA) Board of Trustees 2023 report projects the combined trust funds for Old-Age and Disability Insurance (OASI and DI) will be depleted in 2034.