Silver Reaches Escape Velocity, Costco Daily Recap, FedWatch Pushes Rate Increase to Sept, Gold and Silver Charts

Weekly Recap for the Week Ending April 12, 2024

1. Silver reaches escape velocity

Last week I wrote:

Has the Fed lost control of gold and silver pricing? While it’s too early to tell I think we could say that they are in the process of losing control.

That was last week while this week’s major headline news was persistent inflation. Consumer prices rose 0.4% in March, leaving the annual inflation rate at 3.5%. This is slightly higher than February's rate, reports the Bureau of Labor Statistics. This had little effect on precious metals other than to temporarily slow upward momentum.

Following the CPI report, new data shows wholesale inflation (as measured by the Producer Price Index) rose a modest 0.2% in March. This increase is lower than the 0.3% projected by Dow Jones analysts. Metals responded by continuing their march higher, with silver briefly touching $30 in trading today (the day ain’t over yet.)

I believe the Fed's grip on gold and silver prices is slipping. Other market forces are now breaking free from the gravity of central bank policies. With the momentum building, I expect silver's upward surge to continue.

Check out my 40 Emergency 'Go Bag' Essentials From Amazon

2. Costco Daily recap (April 5 - 11)

These are the daily deals in Costco bullion we captured over the last week.

(4/05) 1 oz Gold Bar PAMP at Costco... $2,359.99

(4/06) 2024 1 oz Gold Buffalo Coin at Costco... $2,359.99

(4/06) 2024 1 oz Gold Eagle Coin at Costco... $2,359.99

(4/08) 2024 1 oz American Silver Eagles 20-count at Costco...$669.99

(4/08) 1 oz Gold Bar Rand Refinery at Costco… $2,369.99

(4/11) 2024 1 oz American Silver Eagles 20-count at Costco...$669.99

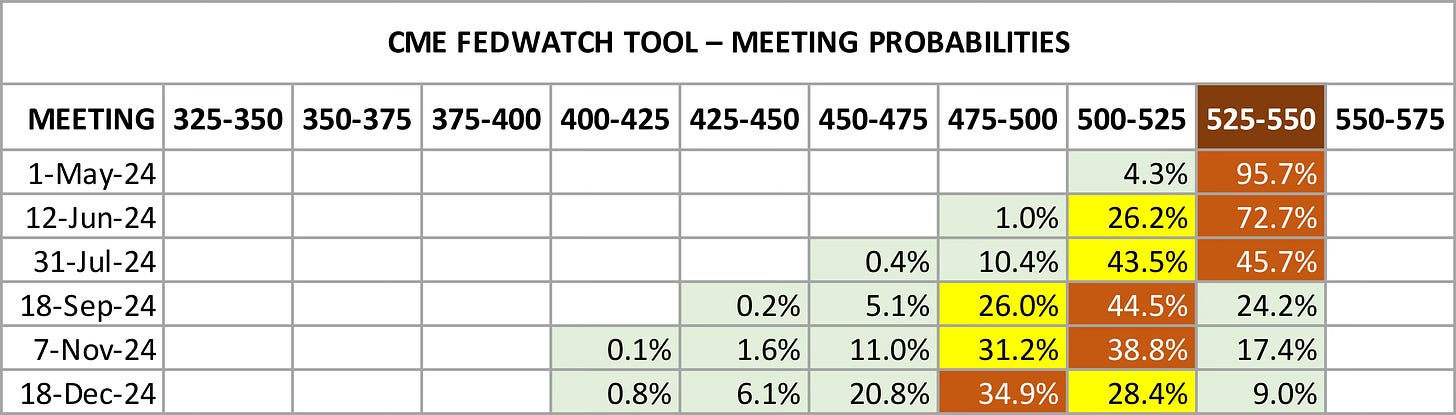

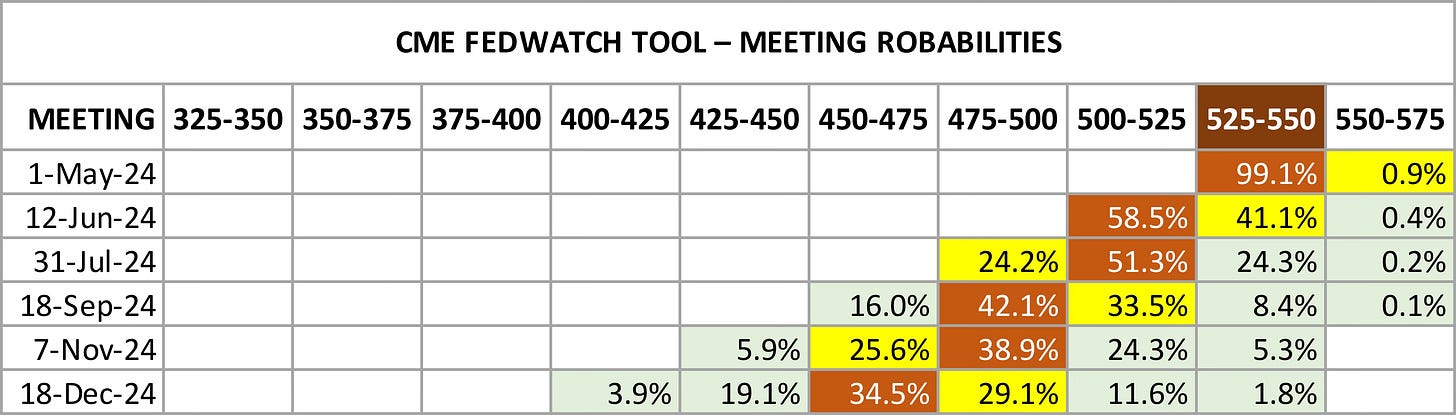

3. FedWatch pushes rate increase out to September

Following the BLS report, traders pushed the first expected rate cut out to September, according to the CME Group FedWatch tool.

The most likely scenario is one rate cut in September or November (red shade) and then one more in December for two cuts totaling 25 basis points.

4. Gold and silver charts

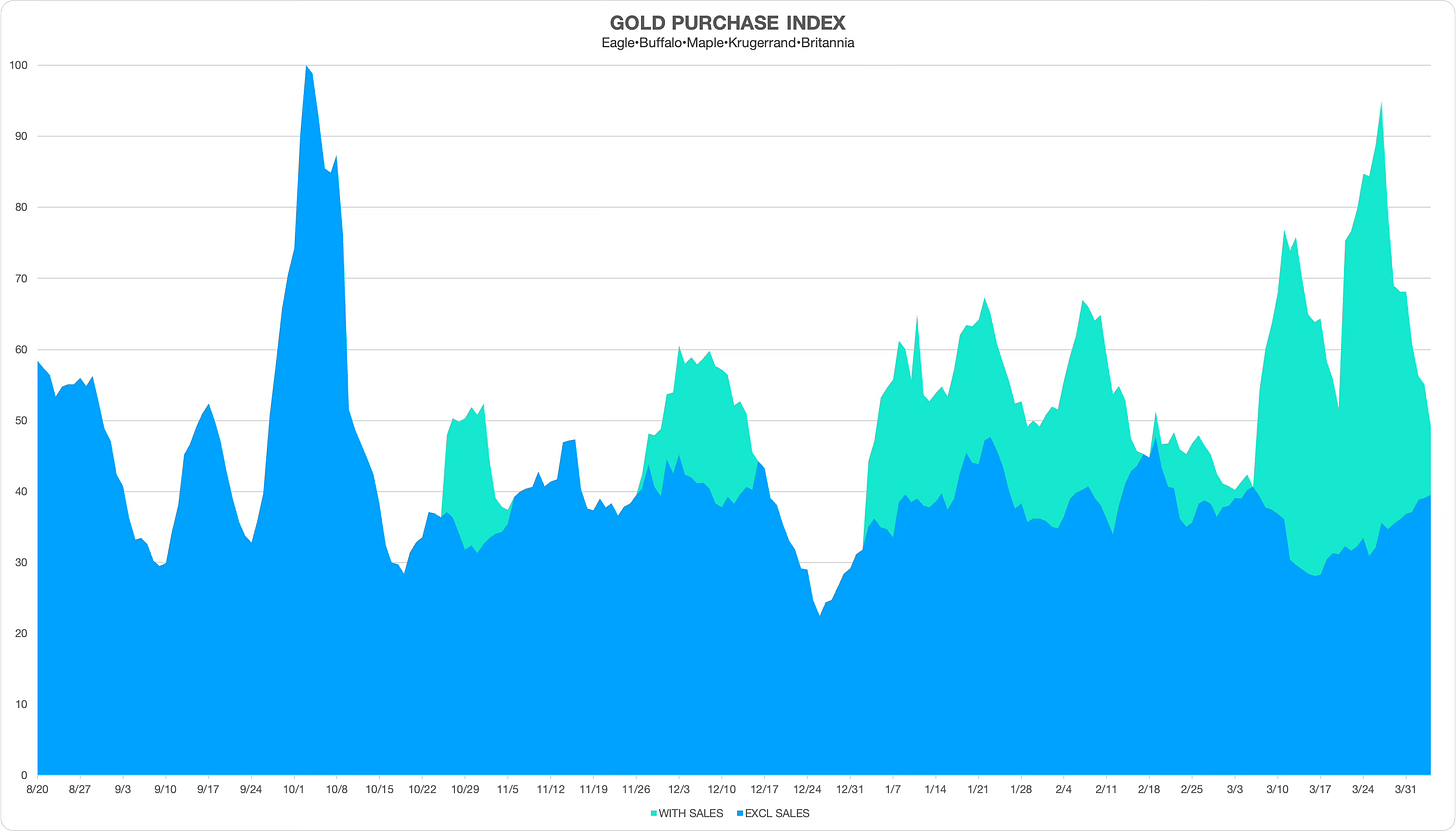

Gold

Sale prices (green shade) have reduced overall but physical gold coin buying increases along with rising gold prices. As investors get used to these higher prices, with a floor possibly in at $2,300, buyers aren’t shying away.

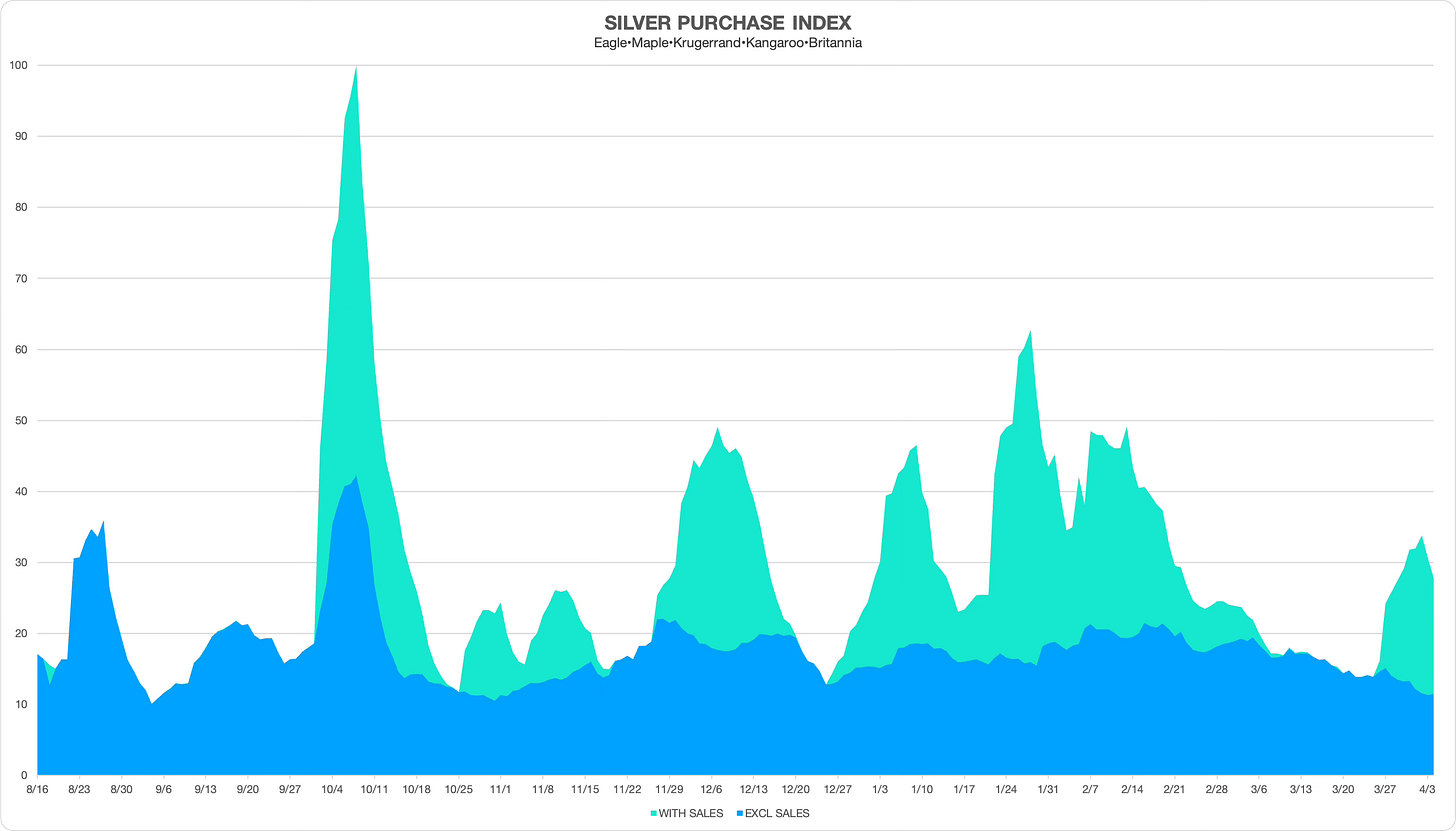

Silver

Regular-price bullion volume continues to trend down since February showing that buyers are not willing to chase physical silver prices higher.

Disclaimer: City Stacker is intended to provide general information and personal opinions related to disaster preparedness and investing in precious metals. I am not a certified financial planner (CFP), chartered financial analyst (CFA), or a certified public accountant (CPA). The content of this publication should never be considered a substitute for professional financial advice. Before taking any action based on anything within this publication, you should always consult with a qualified financial professional familiar with your unique situation. Investing involves risks, and I am not liable for any investment decisions made or results obtained from the use of information in this publication.